What is a DAO: Decentralized Autonomous Organizations in crypto

DAOs, or Decentralized Autonomous Organizations, are expected to use crypto enthusiasts to supplant traditional agencies. So, permit’s take a look at what DAOs in crypto are, how they are painted, and the benefits and challenges of this new token-based totally governance system. What does DAO stand for?

Table of Contents

- Historical historical past

- What is a DAO?

- How do DAOs work?

- Types of DAOs

- Advantages of DAOs

- Disadvantages of DAOs

- Real-world examples of DAOs

- How to join DAOs

- Future of DAOs

- Historical background

The development of blockchain and smart contracts gave an upward push to a brand new type of corporation without hierarchy and centralized control. The concept of decentralized groups first emerged in 2013, even though back then, they had been referred to as DACs (Decentralized Autonomous Corporations), not DAOs. Each of their subsidiary corporations operated in a decentralized manner; their shares were tokenized, and agreements had been made publicly. Every operation had a public code that would be proven. Over time, the concept evolved and became greater conventional.

What is a DAO?

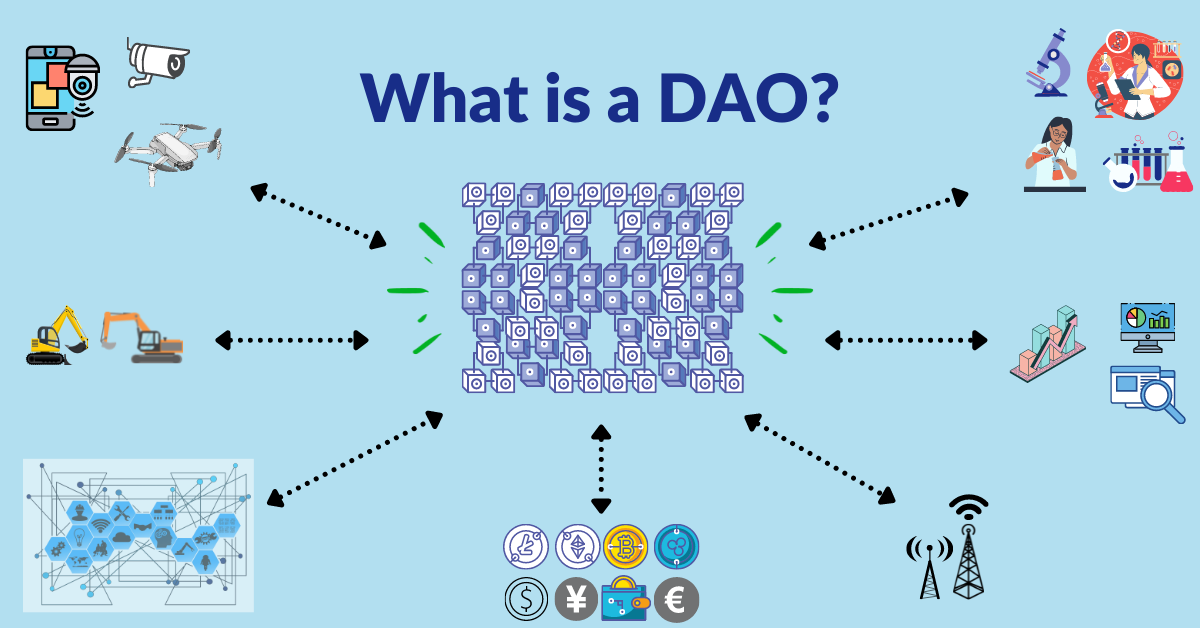

What does DAO mean? Decentralized autonomous corporations (DAOs) are virtual governance corporations powered by the aid of smart contracts running on blockchains. They permit automation and distribution of authority based totally on token incentives.

Issues inclusive of lack of transparency, incapability to get admission to funding possibilities, censorship, and fraud persist in traditional companies.

DAOs in crypto promise to address such problems by making selection-making in groups greater transparent and democratic, regarding even the smallest stakeholder as opposed to some wealthy parents inside the upper echelon.

The approach taken by way of maximum DAOs can change the manner we view agencies nowadays. Imagine a regular client or a member of a body of workers having a real stake in a business and a say in its future activities.

How do DAOs work?

Although the underlying mechanism of maximum DAOs differs based on cause, all of them depend upon the decentralized and immutable nature of blockchain networks (or disbursed ledgers) to efficiently characterize.

In a standard decentralized self-sufficient business enterprise (DAO), a group of people with unusual hobbies collect online (frequently through Discord) to agree on certain goals and goals that form the basis for the agency. The regulations of the DAO are hooked up via this group and encoded in a clever contract for all capability participants to audit and confirm to recognize how the organization is to feature at every step.

The next step is the funding procedure where members pool finances together to the DAO Treasury in alternate for governance tokens. These tokens represent the percentage of vote-casting rights within the DAO normally proportional to the price range a person contributes. The higher your quantity of tokens, the better your vote-casting rights.

After this kind of process, the DAO goes live on a blockchain network in which all its activities are publicly recorded on-chain. At this point, the rules and shape of the DAO can’t be modified or adjusted except when token holders decide to do so through a consensus.

Members of a DAO make proposals about the destiny sports of the business enterprise which includes treasury allocation, protocol fixes, and many others., after which vote together on those proposals. Proposals that skip a positive threshold of votes are mechanically carried out via clever contracts.

Some DAOs use structures where individuals assign their balloting rights to more experienced folks who could make essential decisions. The incentive to vote unbiasedly in the end favors token holders because the growth/achievement of a protocol outcomes in an boom in the price of its tokens.

Types of DAOs

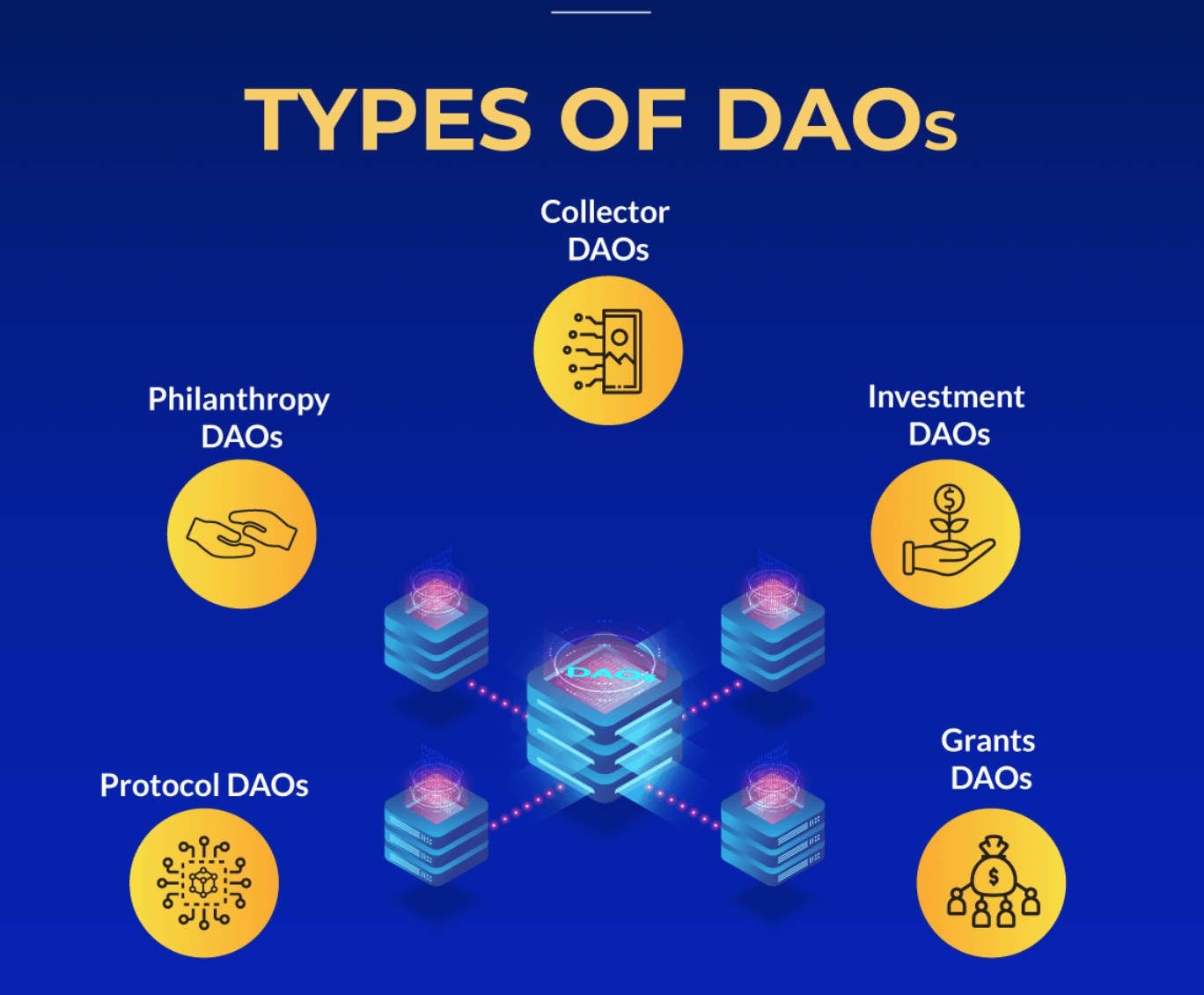

Now allow us to take a look at the specific styles of DAOs in crypto you can encounter within the budding world of web3.

Protocol DAOs

Protocol DAOs are formed to supervise the future of decentralized programs (DApps). For instance, DeFi protocols wouldn’t be effectively decentralized if their developers had been entirely responsible for executing improvements. To resolve this task and foster decentralization, protocol DAOs allow users to manage a protocol for the usage of tokens collectively.

Governance tokens are often presented to users primarily based on their usage of a protocol by offering liquidity and protecting some specific tokens.

Social DAOs

Social DAOs are organized around a set of human beings with comparable pursuits who come together to form online groups managed via a governance token.

The cognizance may be to build a community of individuals who are like-minded in a selected vicinity like arts, sports activities, or music. To join such DAOs, you typically need to hold a positive component in their local tokens, fill out a questionnaire, or even be voted in by way of other participants.

Investment DAOs

These DAOs democratize the investment method by pooling resources from contributors to put money into property or begin-ups (by and large crypto-based totally).

Investment DAOs allow common traders to get the right of entry to funding possibilities which are usually reserved for the top wealthy folks. This can be investing in DeFi protocols, buying uncommon NFT pieces, or even purchasing a sports activities crew.

Philanthropy DAOs

In this kind of DAO, participants pool the budget collectively to fund charitable businesses. Unlike funding DAOs, where contributors completely pool price range for funding functions, looking forward to a return on their investments, participants of philanthropy (or provide) DAOs won’t get something out of their efforts.

An instance is the Ukraine DAO, which changed into capable of raising $8 million in ETH for the Ukrainian military in their warfare against Russia.

Service DAOs

Similar to online talent acquisition corporations, service DAOs encompass a set of abilities international that build services and products. Contributors to such DAOs are generally assigned a governance token that they use in dealing with the DAO Treasury.

Clients of provider DAOs encompass other crypto projects like DeFi protocols, GameFi projects, and other DAOs.

Media DAOs

Media DAO’s goal is to restructure media structures by way of the use of token incentives to reward customers and content material creators.

Users who make contributions through articles, graphics designing, advertising sports, research, podcasts, and so on. Receive praise inside the governance tokens of the DAO. This allows them to have a stake and contribute to selection-making inside the DAO.

Advantages of DAOs

Let’s take a look at the blessings of DAOs.

DAOs permit a greater obvious way of handling agencies.

The structure of maximum DAOs is designed to favor stakeholders instead of a single entity.

DAOs permit the fractional possession of large-scale investments that common buyers can’t come up with the money for.

DAOs are proving to be a faster way for capital formation.

DAOs are in part free from human intervention as selections are automatically finished through clever contracts

Disadvantages of DAOs

While DAOs should assist in improving conventional organizational structures, in addition, they include their truthful percentage of challenges.

DAOs could be fairly gradual in decision-making in comparison to conventional corporations.

Smart contracts are liable to attacks which could bring about the loss of funds.

Some technical selections require knowledge that regular DAO members won’t own.

Most international locations lack regulatory frameworks for running DAOs.

Real-world examples of DAOs

Now, let’s take a look at a handful of high-profile DAOs.

The DAO

Notable for causing the Ethereum difficult fork, The DAO became the primary try to create a decentralized self-sufficient organization. The DAO was presupposed to be a kind of decentralized challenge capital fund that allowed investors to pool funds in exchange for tokens that allowed them to vote on the way to spend price range in its treasury.

The DAO became capable of improving approximately $150 million in ETH in a month in an effort considering the biggest crowdfunding marketing campaign at the time. However, a malicious entity exploited some vulnerabilities in The DAO’s code to empty about $50 million.

Considering that the DAO held approximately 14% of ether at the time, it could have signaled an end for the Ethereum community. Hence, Ethereum miners determined to implement a hard fork that moved the stolen tokens to a new settlement address, allowing members to withdraw their tokens in ETH.

Constitution DAO

In November 2021, a group of Twitter users pooled approximately $47 million worth of ETH in a smart contract to participate in an auction of a rare replica of the original US Constitution by Sotheby’s.

The organization subsequently misplaced a bid of $43.2 million inside the public sale as they believed a higher bid wouldn’t be possible thinking about the extra price range they would have spent on moving and insuring the artifact. The institution later refunded participants their cash by permitting them to redeem their tokens at a fee of one ETH: one million $PEOPLE – the equal charge to which they contributed.

MakerDAO

Launched in 2015 and fully operational on the Ethereum blockchain via 2017, MakerDAO has become a key player within the global decentralized finance (DeFi). It added DAI, a stablecoin tied to the American dollar, designed to offer balance amid the United States of America’s downs of cryptocurrencies. This step forward allowed economic experts to transform volatile crypto property into something extra reliable, similar to the reliability of the United States greenback.

Operating as a peer-to-peer lending platform, MakerDAO shall we customers borrow DAI by using different cryptocurrencies as collateral.

Uniswap

Uniswap is a decentralized change on Ethereum. Instead of using the ordinary order book observed on other exchanges, it employs an Automated Market Maker (AMM) machine. Basically, in preference to matching specific buy and sell orders, Uniswap permits customers to pool two belongings collectively. These belongings are then exchanged directly with each other, and the charge depends on the quantity of every asset in the pool.

Uniswap operates with no need for a central authority. If you have personal UNI tokens, you have a say in how things are controlled. You can vote on matters including the destiny management of Uniswap and which token swimming pools should acquire buying and selling prices. It’s designed to present customers with greater affect over how the alternate operates.

Dash DAO

Dash DAO is taken into consideration as one of the earliest DAO projects. Dash dependent its mining rewards in a manner that 45% is going to miners, 45% to Masternodes, and 10% to a treasury. Masternodes vote on proposals for spending funds in the Treasury by locking up 1,000 DASH tokens. This is to ensure that voters have a sizeable stake in the impact of their selections.

The Dash DAO says it has used funds in the treasury to rent developers and designers, buy a domain called — Dash.Org, sponsor meetings, buy development hardware, and more.

How to sign up for DAOs

Typically, every person can take part in a DAO by purchasing the DAO’s token for the duration of a public token sale or on the open marketplace (if to be had). Once an individual or a corporation holds tokens in a DAO, it can contribute to the undertaking’s choice-making process by way of voting using its tokens.

However, if the DAO’s tokens aren’t available for sale to the general public, becoming a member of a DAO may contain learning about the crew and building a relationship with members of the crew earlier than you’re supplied with get entry to.

Future of DAOs

While it’s still early days in the world of Decentralized Autonomous Organizations, proponents are convinced that decentralized governance models will play an important function in the next iteration of the internet.